Backed by the 36 year legacy of the ASM Group of Institutes, IMCOST is one of the top ranked B-Schools in Mumbai. Institute of Management & Computer Studies (IMCOST), was established in 2004 in Wagle Industrial Estate ,Thane, Maharashtra.

Located in the industrial belt of Thane, the institute offers its students consistent industry interaction, enabling students to learn from the leaders. The sole objective of founders was to provide opportunity to students belonging to all sections of the society for acquiring quality education in Management and commerce stream at undergraduate level. Our Institute is affiliated to University of Mumbai.

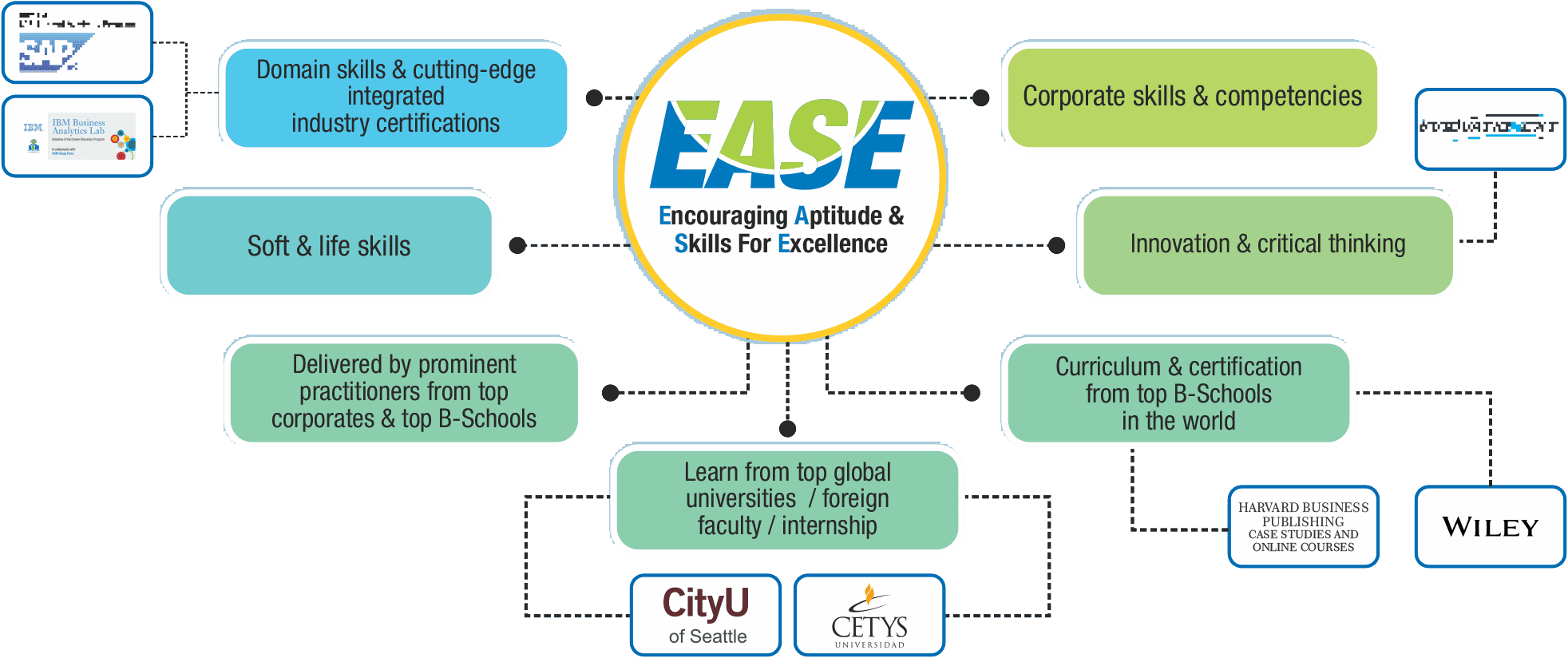

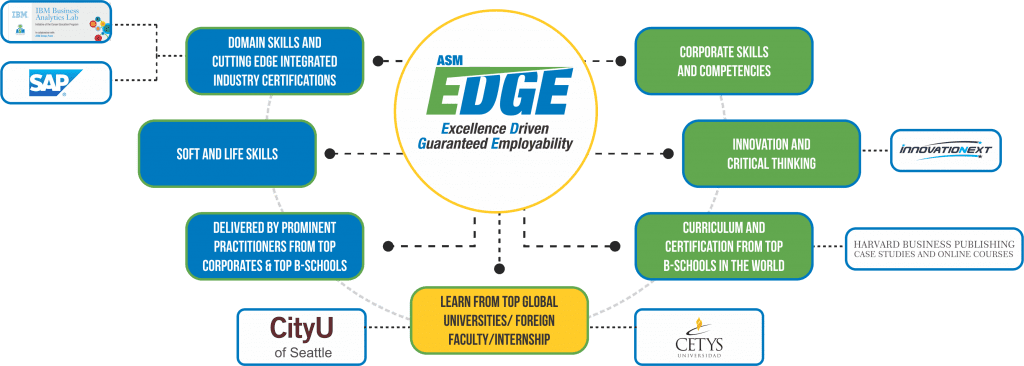

Our Institute’s premises are well equipped to satisfy all academic, extracurricular and social needs of the student community. Our faculties are qualified and experienced in their line of specialization and comply with eligibility criteria for teachers specified by University of Mumbai. We have multiple collaborations with best in industry and academia which enables us to provide optional integrated industry oriented courses like CMA, CFA, CSCA along with CC, MC, BA, DM and LM for assuring enhanced employability opportunities for students. Our library is well stocked with books prescribed by University and for reference E-Books, magazines are also available.