Duration: 2 Years

Key Facts

Course Type: Full Time

Course Start: August 2019

About Course

The Post Graduate Diploma in Management (PGDM) in International Finance Integrated with US CPA offered by ASMs IMCOST,one of the top colleges in Thane, India for PGDM in finance,aims at training the students for CPA Certification. A CPA will have knowledge of

- US Generally Accepted Accounting Principles (GAAP)

- International Financial Reporting Standards(IFRS)

- Generally Accepted Accounting Standards (GAAS)

- US federal taxation and business laws

And, this gives them an edge over traditional CAS. The PGDM Program, clubs the CPA training with the much-required additional Skills from Harvard Business Schools HBS Online & SAP training on the Finance module. Thereby ensuring the PGDM graduate from ASMs IMCOST is a perfect match for the industry. Making us the most sought after PGDM college for international finance in Pune, India.

Program Objectives

The Post Graduate Diploma in Management (PGDM) in International Finance Integrated with US CPA aims at training the students for CPA Certification. A CPA will have knowledge of US Generally Accepted Accounting Principles (GAAP), IFRS(International Financial Reporting Standards), Generally Accepted Accounting Standards (GAAS), US federal taxation and business laws which will give them an edge over CAS. The PGDM Program clubs the CPA training with the much required additional skills from Harvard Business Schools HBS Online & SAP training on the Finance module, Financial Analytics from IBM, online courses & case studies from Havard Business Publishing, thereby ensuring a PGDM graduate is a perfect match for the industry.

WHY Study Post Graduate Diploma in Management (PGDM) International Finance integrated with US-CPA at IMCOST in Thane

Students develop a firm level of understanding of the key functions of business in todays global economy, as well as acquire entrepreneurship skills. Moreover, students get 100% engagement with the industry to learn about the practical work environment in the professional world.

Following are the top reasons why students should pursue PGDM course in International Finance with US CPA in Pune from ASMs IMCOST,one of the best management colleges in India.

- Internships leading to 100% guaranteed placements at global organizations.

- The course of PGDM International Finance integrated with US CPA is focused towards giving students actual industry experience ensuring skill developing hands-on training.

- PGDM International Finance integrated with US-CPA(curriculum designed and training delivered by MILES, the leading CPA trainers in India.

- ASM Edge for holistic development & employability.

- 360o grooming to meet industry needs & demands.

- Course content core developed by leading industry experts.

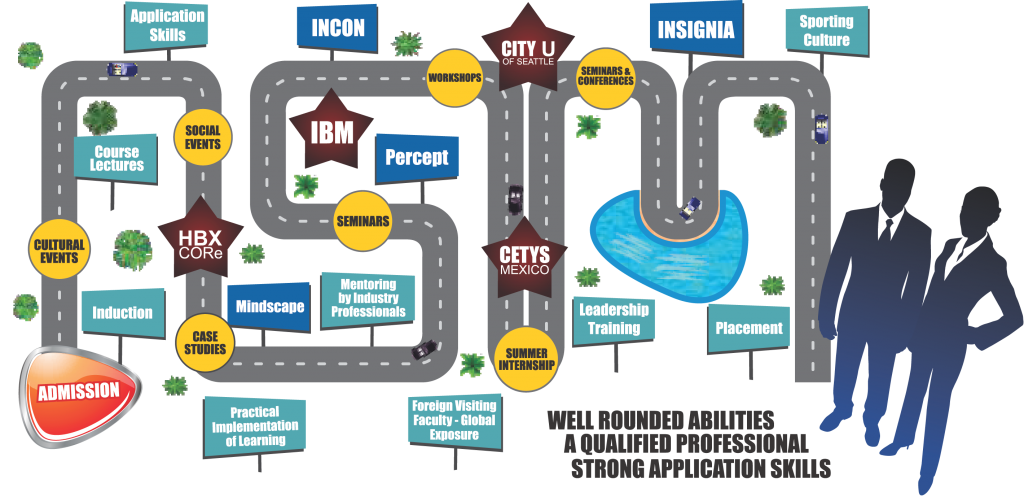

ASM Students Have Consistently Proven to be Industry- Ready Professional with Well-Rounded Abilities

Admission to PGDM Institutions shall be made only from the candidates qualified from any one of the six All India tests i.e.; CAT, XAT, CMAT, ATMA, MAT, GMAT or the common entrance examinations (if any) conducted by the respective State Governments.

- Score in any one of the six All India tests i.e. (CAT, XAT, CMAT, ATMA, MAT, GMAT) or the common entrance examinations (if any) conducted by the

respective State Governments. 35 to 60% . - Score for academic performance in X Std., XII Std., Under Graduate Degree/ Post Graduate Degree 5 to 25% .

- Group discussion/interview 20 to 45% .

- Weightage for participation in Sports, Extra Curricular Activities, Academic diversity and Gender diversity 5 to 20%

The program comprises of intensive classroom learning held at our Thane, campus, along with Industrial Training and Internship delivered in association with top industry partners. These features make it one of the most sought after post graduate diploma courses in Thane, India.

|

Year 1 |

| Trimester 1

101 Essentials of Business Management 102 Management Information System 103 Business Analytics 104 Financial Accounting 105 Economics for Managers 106 Quantitative Aptitude 107 Finance – by HBP 108 Management Communication- by HBP 109 Spreadsheet Modeling-by HBP |

| Trimester 2

201 International Business Environment 202 International Financial Management 203 Advanced Financial Accounting & Reporting I-by Miles 204 Auditing & Attestation- I-by Miles 205 Management Accounting-by Miles 206 Quantitative Methods-by HBP 207 Financial Accounting-by HBP 208 Mathematics for Management-by HBP |

| Trimester 3

301 Overview of International Marketing Management 302 Analytics for All- AFA by IBM 303 Advanced Financial Accounting & Reporting II – by Miles 304 Auditing & Attestation- II-by Miles 305 Business Environment & Concepts |

| Industrial Training on Live Project 2 months – by MILES |

|

Year 2 |

| Trimester 1

401 Project Viva 402 Financial Analytics – by IBM 403 Advanced Financial Accounting & Reporting III-by Miles 404 Federal Taxation-by Miles 405 Business Law-by Miles |

| Trimester 2

501 Entrepreneurship Development & Project Management 502 Business Strategies 503 SAP End-user training 504 Global Investment Industry -by Miles 505 Investment Management – by Miles |

| MILES – Industrial Apprenticeship Leading to 100% Placements |

A student completing PGDM in International Finance integrated with US CPA can look at niche opportunities like:

International Accounting: International accounting manager is responsible for looking after foreign trade agreements, international business transactions, & other global financial & economic issue.

General Accounting: Candidate will be responsible for all the accounting activities of the organisation from making of financial statements to valuing stocks & making critical decisions.

Auditing: External auditors are required to be CPAs to audit MNCs who are based or have raised capital in the US. These audits are often done by the Big 4 providing extensive career progression opportunities to CPAs.

Tax Accounting: CPAs are considered to have expert knowledge about taxation & therefore the demand for them in the taxation field is growing. You can work as a tax specialist, sales tax specialist or international tax manager and other profile related to taxation.

Forensic Accounting: Investigation expertise for the white collar crimes like fraud, money laundering, bribery etc & analyses financial information for use in the legal proceedings of a company.

Environmental Accounting: Environmental Auditors ensure compliance with environmental laws through audits that are aimed at reducing liability & identifying opportunities for more sustainable operating practices.

Information Technology: A PGDM in International Finance can work as a Certified Information Systems Auditor (CISA) & look after the IT governance or as a Software Revenue Manager that works as a link between the IT team & the finance department.

START YOUR EXTRAORDINARY JOURNEY TOWARDS QUALITY EDUCATION JOURNEY AT ASM'S IMCOST, THE COURSE WHICH IS DESIGNED AND DELIVERED BY INDUSTRY EXPERTS, STALWARTS AND FOREIGN FACULTIES WITH INTEGRATED EXCELLENCE DRIVEN GURANTEED PLACEMENTS.

Placement Partners

[wpaft_logo_slider category=”placement-partners”]